Effective Systems for Tracking Income and Expenses for Small Business Financial Health

As a small business owner, it's crucial to track your income and expenses to ensure the financial health of your business. Here are some effective systems for tracking income and expenses:

Accounting Software: Accounting software is an excellent tool for tracking income and expenses. It automates bookkeeping processes, such as invoicing, expense tracking, and financial reporting. Examples of accounting software include QuickBooks, Xero, and FreshBooks.

Spreadsheets: Spreadsheets are a simple and effective way to track income and expenses. You can use a spreadsheet program like Microsoft Excel or Google Sheets to create a budget, track expenses, and create financial statements.

Receipt Management Tools: Receipt management tools like Expensify and Shoeboxed can help you track expenses by digitizing receipts. They allow you to capture and store receipts electronically, which can save you time and reduce the risk of lost receipts.

Bank Account Reconciliation: Reconciling your bank account is a process of comparing your business bank account balance to your accounting records to ensure they match. By reconciling your bank account regularly, you can catch any discrepancies or errors early and prevent potential financial problems.

Budgeting: Creating a budget is essential to track your income and expenses effectively. A budget can help you plan and allocate resources, identify areas where you can cut costs, and ensure that you have enough cash on hand to cover expenses.

Cash Flow Management: Cash flow management involves tracking the flow of money in and out of your business. It's essential to monitor your cash flow to ensure you have enough cash to cover your expenses and investments.

Regular Financial Statements: Creating regular financial statements like Profit and Loss statements, Balance Sheets, and Cash Flow Statements can help you understand the financial health of your business. They provide insights into your business's revenue, expenses, assets, liabilities, and cash flow.

Tracking your income and expenses is crucial for the financial health of your small business. Implementing systems like accounting software, spreadsheets, receipt management tools, bank account reconciliation, budgeting, cash flow management, and regular financial statements can help you track your income and expenses effectively. By monitoring your financials, you can make informed business decisions, prevent financial problems, and ensure your business's long-term success.

Help! I am not ready for all that!

Get a separate Bank account for your business.

Start off right. Get an Employer Identification Number (EIN). It is basically a Social Security Number (SNN) for your business. The IRS website can lead you on how to do that and it only takes a few minutes. Take the document you get from them to your bank or Credit Union (CU) and open an account for your business.

The Bank/CU may ask for a business license, but that is also easy to get online in Oregon through the Secretary of State’s office. Most other states have a similar process.

Side Note: Do this directly through your state (or county office). There are third party vendors who are happy to fill out a form for you, but it will cost you, likely double.

We get a very official looking document about 2-4 months before our annual business license fee is due. A close examination shows it is not from the state of Oregon and the fee includes and extra $90 for the service. Avoid it.

In many cases you can open the Bank/CU account with very little money - often as little as $100. Check your banking institutions website for limits.

Remember banks are businesses and their goal is to make money. Consider a Credit Union instead, they are Federally insured and offer the same protections, but are often a cheaper place to keep your money. CU’s often have programs to assist small and beginning businesses.

Deposit every bit of income - no matter how small into your business account. This will help with tax preparation later. As soon as you can, purchase all of your business expenses from that same account. Try not to intermix personal and business income and expenses or it will complicate accounting later.

Pay yourself by writing a check from your business account to your personal account. Keep these two separate.

Start with a notebook. Write everything down.

When you are just getting started, this can get overwhelming fast. Get a regular notebook and write it all down. Figure out what

Here is a good Free Resource. You can spend $20 on a book to track each of these or just print out a few or several pages and buy a fancy book later when your business is up and running.

Checking account Ledger – Print as many as needed to keep track of checking account.

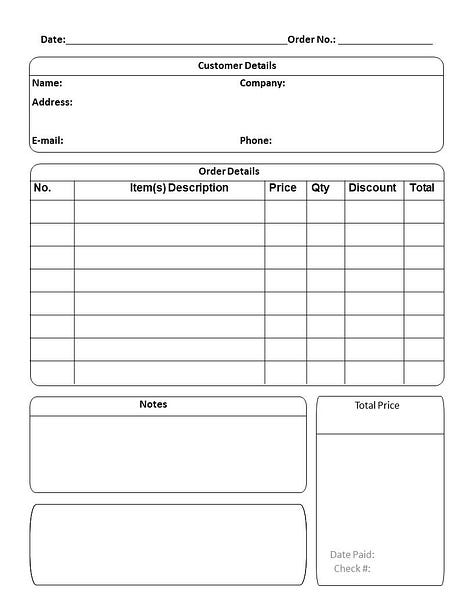

Customer Details/Order Details - Use this to keep track of what a customer needs each visit. Can be used as an estimate or receipt for the customer.

Mileage Log – Keep track of business mileage each day for tax purposes. Add in any maintenance or repair costs at the bottom as needed.

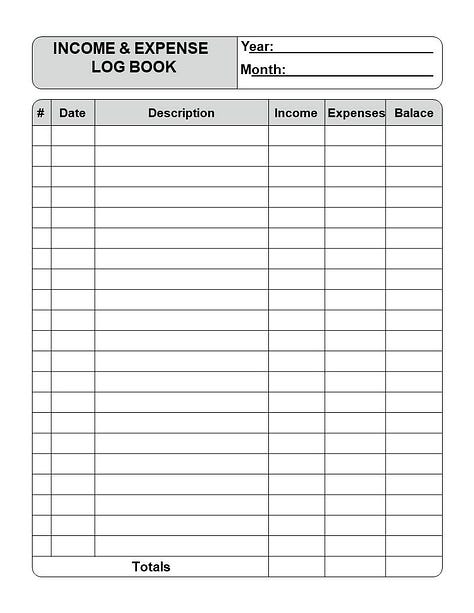

Income & Expense Log Book and Notes – Print double sided. Record each Income or Expense as they happen. Record notes if something unusual occurs. Don’t plan to remember it later – write it down now!

Page/Index – print one sheet to organize up to 25 Client Profiles.

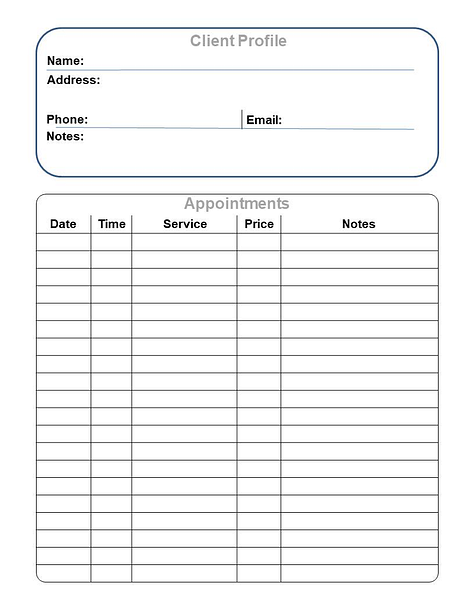

Client Profile/ Appointments – Print as many as needed to keep track of each contact with a client.

What works best for you?

Make a point to write down everything as it happens. Don’t rely on your memory at the end of the week or even the end of the day. Keep these forms and any others you create with you. As soon as you leave a client, write it down.

Develop a good system for keeping track of who you worked for or with, what product or service you sold and when you did it. If it involves a number write it down. for example, if your business is mobile write down every mile you drive to get to your customer. Write down the amount of gas for your vehicle (the tax guy won’t care how much you spend on gas, but it will help with planning for the next month or year). The miles you drive can be written off of your tax bill. As can most supplies and tools you use to serve the customer.

Don’t feel like you must get it perfect the first time. Make adjustments as needed to improve your record keeping system. Keep all of your receipts. If you work on the road, be sure to have a receipt envelop in your vehicle and put everything in there as soon as you are back inside. Go through the receipts weekly - depending on your volume - and organize them into groups. Consult with a tax person as soon as you can to get those categories correct.